401k max contribution calculator

After not being able to find any calculator or formula online for what I was looking for I decided to sit down and create my own. Many employees are not taking full advantage of their employers matching contributions.

Employer 401 K Maximum Contribution Limit 2021 38 500

The contribution limit for 2022 is 20500.

. To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current financial situation. Employers usually set a limit on their match either as a certain dollar amount or as a percentage of the employees salary. The annual maximum for 2022 is 20500.

Solo 401k Contribution Calculator. As an exampl See more. Ad Maximize Your Savings With These 401K Contribution Tips From AARP.

The 401k Retirement Calculator uses the following basic formula. Employees are allowed to contribute a maximum of 19500 to their 401 in 2020 or 26000 if youre over 50 years of age. Individual 401 k Contribution Comparison.

401k savings calculator helps you estimate your 401k savings at retirement based on your annual contribution and investment returns from now until. There can be no match without an employee contribution and not all 401ks offer employer matching. This calculator below tells you what percentage.

This federal 401k calculator helps you. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. If for example your contribution percentage is so high that you obtain the 20500 year 2022.

Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. This limit increases to 67500 for 2022 64500 for 2021 63500 for 2020 if you include catch-up contributions. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. Ad If you have a 500000 portfolio download your free copy of this guide now.

Plan For the Retirement You Want With Tips and Tools From AARP. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. The good news is employer contributions do not.

Consider a defined benefit plan if you want to contribute more. A 401k match is an employers percentage match of a participating employees contribution to their 401k plan usually up to a certain limit denoted as a percentage of the employees salary. This calculator has been.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Rules for Contributing to an S-Corp 401 k 3. First all contributions and earnings to your 401 k are tax deferred.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. How to use 401k calculator. You can elect to contribute the annual maximum limit of 18000 or 24000 if.

The limits for 2020 and 2021 set by the IRS are 19500 for a 401K plan. Your annual 401k contribution is subject to maximum limits established by the IRS. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and.

If you are age 50 or over a catch-up provision allows. You can only contribute income that is reported on your W-2. It provides you with two important advantages.

The IRS also limits the total contributions to 401k accounts. A 401 k can be one of your best tools for creating a secure retirement. In addition the amount of your compensation that can be.

If you dont have data ready to.

The Maximum 401k Contribution Limit Financial Samurai

401k Contribution Calculator Step By Step Guide With Examples

Free 401k Calculator For Excel Calculate Your 401k Savings

Doing The Math On Your 401 K Match Sep 29 2000

401k Contribution Calculator Step By Step Guide With Examples

401k Employee Contribution Calculator Soothsawyer

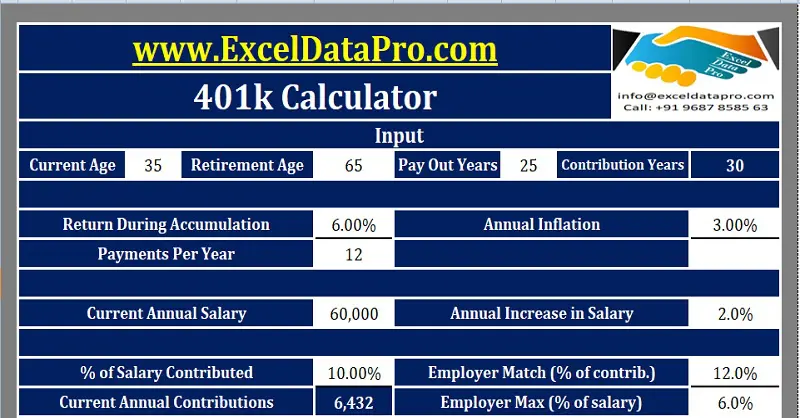

Download 401k Calculator Excel Template Exceldatapro

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401 K Calculator See What You Ll Have Saved Dqydj

Download 401k Calculator Excel Template Exceldatapro

401k Employee Contribution Calculator Soothsawyer

Excel 401 K Value Estimation Youtube

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Limits And Types

401k Calculator

Retirement Services 401 K Calculator

Customizable 401k Calculator And Retirement Analysis Template